Bitcoin Basics in 2021

Bitcoin Basics for Real Estate Agents in 2021 ( + Expert Predictions)

At Sheri Dettman & Associates, we have always prided ourselves on being ahead of the curve. Bitcoin, and blockchain, although they have been around for a few years, are still something that is not yet widely understood in the Real Estate world. This article makes it easy to understand! We look forward to using blockchain tech and being your go-to agents with, as always, the latest, and best technology along with the best personal service.

February 4, 2021/Courtesy of Emile L'Eplattenier

One of the most common questions we get from real estate agents these days is when, or even if, bitcoin will finally make its way into real estate transactions.

Of course, if agents are asking us that, it means their buyers and sellers are probably asking them. So it’s only a matter of time before understanding how this technology works will be necessary for any agent who doesn’t want to get left in the dust of yet another disruptive technology for real estate.

The only problem is that bitcoin is—and there’s no other way to say it—confusing. Don’t worry, though. Even people who are so-called experts in the field can have a hard time explaining it.

That’s why we put together this quick explainer on bitcoin for real estate agents and also talked to a few agents and brokers who have already taken the leap to get their take on how they think bitcoin will transform the real estate industry in 2021 and beyond.

Can My Buyers Purchase a Home With Bitcoin Yet?

Kind of. However, almost all real estate transactions using bitcoin have used a service called BitPay to convert bitcoin to U.S. dollars (USD) to transfer funds to the seller.

As far as “bitcoin-to-bitcoin” transactions go, where title changes hands and the bitcoin is never converted into USD—they still remain very rare. The sticking point is generally title companies and lawyers, both of whom are still somewhat reluctant to use the digital currency.

Douglas Elliman’s Stephan Burke and Carol Cassis sold the first property using bitcoin wallets in 2017, as well as a $6 million transaction after that, the largest fully bitcoin translation to date. Since then, they have closed more than $34 million in volume using cryptocurrency converted to cash.

However, while it has been slow going here, where bitcoin and blockchain show the most promise is for overseas transactions.

Over at the always-excellent Mansion Global, EminGun Sirer, associate professor of computer science and co-director of the Initiative for Cryptocurrencies and Smart Contracts at Cornell University, weighed in on why cryptocurrencies are ideal for foreign buyers:

“Cryptocurrencies enable the quick, frictionless transfer of value across the globe. This enables someone in Russia to be able to easily send bitcoins to purchase land in Belize.”

Should I Advise My Sellers to Accept Bitcoin?

In today’s market, bitcoin may not be ready for prime time, but there is one thing that is undeniable. Offering your listing for sale in bitcoin will get you instant free press. Remember the first listings that had drone videos? Imagine that times 10. Here’s Seattle Realtor, Sam Debord:

“I’ll sell my house for bitcoin” is the latest marketing tactic, and it’s working … at least for publicity.”

In order to accept bitcoin, you can either have the seller transfer into USD, work with a title company that will accept bitcoin, or have a lawyer write up a contract that covers all risks from bitcoin. At this point, most people will avoid actually paying in bitcoin, but the free press might be a good trade-off.

Can My Buyers Get a Loan With Bitcoin?

Yes. Startups like Unchained Capital allow people who hold bitcoin to borrow up to $1 million with no credit check and interest rates between 10% and 14%. However, these are not long-term loans; Unchained offers loan lengths ranging from three months to three years.

While not for everyone, hardcore bitcoin owners use services like this to get quick liquidity without cashing in their bitcoin portfolios. Think down payments, or maybe even bridge loans.

There Must Be a Catch … Is There Capital Gains Tax for Transferring Bitcoin to USD?

Yes. As of January 1, 2018, the federal government considers cryptocurrency as property and anyone selling (or trading bitcoin for U.S. dollars) will be hit with capital gains tax on the amount their bitcoins appreciated since they purchased or mined them.

Are Bitcoin & Blockchain the Same Thing?

No. While bitcoin is a digital currency that you can exchange for goods and services, blockchain is the underlying technology that stores bitcoin or other cryptocurrency transactions in a digital ledger.

Okay, Then What Is Bitcoin Exactly?

Bitcoin is a fully digital currency created in 2009 by an anonymous person who goes by the name Satoshi Nakamoto online.

Like any other currency, bitcoin can be used to pay for goods and services, transfer funds, or as an investment. Currently, over 15,000 vendors accept bitcoin, from Microsoft to small businesses.

The main difference between bitcoin and say, an ACH transfer through a traditional bank is that there is no middleman in the transaction. The entire transaction from buyer to seller takes place on the Bitcoin network. Since a bitcoin transaction bypasses the different bank policies, or different regional banking laws that are part of any other transaction, transfers are much faster.

Since there is no bank or government to get in the way, bitcoin can be a great way to transfer money or make purchases overseas. Foreign buyers may find bitcoin’s speed and simplicity ideal for buying property in the United States.

Bitcoin is an example of a fiat currency; its value is not backed up by gold or other tangible assets. Instead, bitcoin relies on something called blockchain to verify transactions.

Got It. So What’s Blockchain?

Although blockchain is very complex, the best way to describe it to your clients is to compare it to ACH, the technology that lets you “wire” money from one bank to another. The main difference is that blockchain does not rely on banks to verify transactions have been completed. Instead, once a transaction is completed, it is stored in an encrypted digital ledger that is distributed among everyone on the blockchain.

This means that instead of relying on trusted institutions like banks to verify transactions, the verification is done very quickly by algorithms that check the stored transaction data on the millions of users on the blockchain.

What makes blockchain so powerful is that the ledger is stored on every single computer (node) in the system. This makes faking a transaction virtually impossible. Since the blockchain is extremely secure, it has many applications beyond verifying and storing bitcoin transactions. Everything from contracts to voting records can theoretically be stored on blockchain.

Which Technology Will Have a Bigger Impact in the Real Estate Market, Bitcoin or Blockchain?

According to most experts, blockchain will have a bigger impact on real estate than bitcoin or other cryptocurrencies. Here’s why: Transaction speed is not a very pressing problem for real estate transactions, but record-keeping and middlemen are. Here’s Jason Shepherd, co-founder of Atlas Real Estate Group, on why he thinks blockchain technology, particularly smart contracts and other applications built on Ethereum, an alternative to bitcoin, will change the real estate market:

“It is important to separate the cryptocurrency from the underlying blockchain technology when discussing real estate disruption. The disruption in real estate will come from the blockchain technology (distributed ledger) and smart contracts like those found on the Ethereum platform.”

So What Are Smart Contracts?

Smart contracts are contracts between two parties that are verified and stored on the blockchain. Today, most smart contracts are built with the blockchain protocol behind Ethereum, another cryptocurrency.

The main benefit behind smart contracts is that there is no need for a middleman in the transaction. Everything is verified and stored on the blockchain.

In the future, blockchain can be used to store records of a transaction all the way from a blockchain-enabled MLS, to escrow, inspections, title, and sales contracts. Leases and other commercial real estate contracts could also be on the blockchain.

While smart contracts haven’t yet hit the mainstream for real estate, startups like Propy and Ubiquity.io are changing that.

To learn more about smart contracts, check out this excellent guide over on Block Geeks.

What Is This ‘Mining’ for Bitcoins I Keep Hearing About?

OK, from here on in, the process gets a bit more technical, and therefore much harder to explain. While it’s unlikely your buyers or sellers will grill you about this, having a basic understanding can help.

Remember how we talked about how transactions on the blockchain are verified by other users? Well, bitcoin mining is the process that verifies transactions and adds them to the public ledger.

Bitcoin “miners” are rewarded with bitcoin for using their computer’s processing power to verify transactions. Before you get too excited and start mining bitcoin out of your broker’s office, understand that in most places, the payment for mining bitcoin will probably be less than the electricity costs to run computers long enough to verify transactions.

What Advantages Do Other Cryptocurrencies like Ethereum, Litecoin & Ripple Have Over Bitcoin?

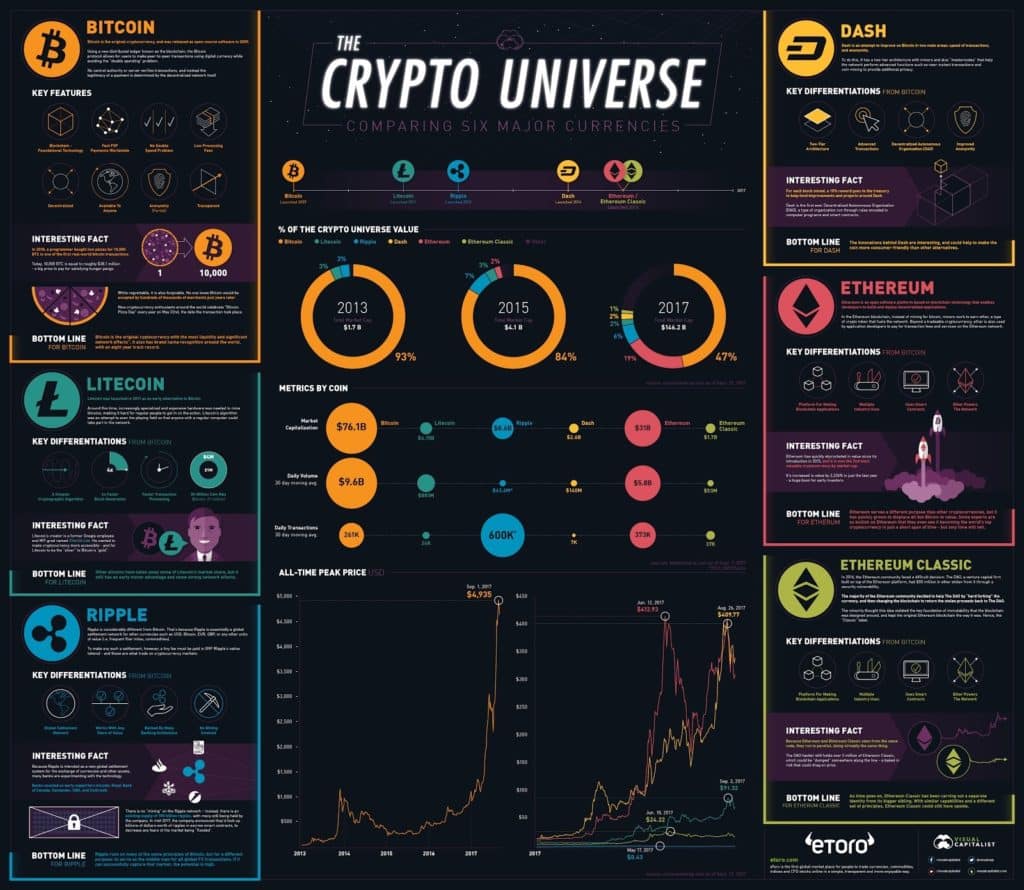

OK, now we’re getting a little too far into the weeds. Worse, the crypto industry changes so fast that by the time you read this, something will have inevitably changed. If you’re feeling brave, check out this cool infographic from Visual Capitalist:

How 10 Real Estate Experts Think Bitcoin Will Disrupt the Industry

So now that you have a basic understanding of bitcoin, here’s how 10 real estate industry experts see bitcoin transforming the real estate market in the coming years.

1. Jason Penner, Douglas Elliman, New York City

“A brief way that I explain bitcoin is, it’s as if technology and finance had a baby. Humans survived for hundreds of thousands of years (if not longer) without money. Money is a relatively new concept to humans, and to think that the current financial system is the peak evolution of money and the storage of value is nothing short of naive. Bitcoin and cryptocurrencies represent that next step in the evolution of storing and exchanging value.”

2. Jim Merrion, Coldwell Banker Realty, Colorado

“The real estate industry’s appetite for using bitcoin to purchase real estate seems to be coming back in a big way in 2021! Being a Realtor who has helped a buyer purchase developable land using bitcoin converted to cash and marketed several listings willing to accept bitcoin as payment, bitcoin investors are finding me online and reaching out with plans to purchase property using these funds in 2021.

“Currently, I have one bitcoin investor looking to buy a 35+ acre ranch property and have spoken to several others over the past few months about how the process could successfully work for them.

“And Smart Contracts are starting to be seriously considered by at least one title company in Colorado now. With their inherent security and ability to prevent wire fraud, there is a lot of motivation by the transaction processing entities to find new technology solutions that reduce their risk and enhance the efficiency of the closing process.”

3. Tristan Ahumada, Realtor, Speaker & Co-founder of LabCoatAgents

“So far, most of the bitcoin transactions in the real estate world have had only one party dealing in cryptocurrency and the other one doing it the traditional way. The deal can still take place, but the cryptocurrency has to be turned into cash. I do envision cryptocurrency catching on more, but our society has to start using the bitcoin/blockchain technology more. I do see it becoming normalized—it’s just a matter of people getting used to it. It is just as easy as people using credit cards and Apple pay.

“For now, there are companies like BitPay and some other international banks that allow people to convert their bitcoin into cash.”

4. Jason Shepherd, Co-founder of Atlas Real Estate Group

“The disruption in real estate will come from the blockchain technology (distributed ledger) and smart contracts like those found on the Ethereum platform. The escrow process will be replaced by a smart contract, using code as the intermediary to distribute earnest money. Imagine a real estate transaction where all of our inspection and due diligence information can be found in one public ledger on the blockchain—ownership, encumbrances, repair receipts, improvements, liens—all viewable and indisputable on the distributed ledger.

“This transparency reduces the need for title insurance and truncates the purchase timeline for a home from 30 days to a few days. Title and escrow will be the first layer of disruption, but increasing transparency will allow the public to access more information and be less reliant on real estate brokers. This won’t replace brokers, but it will warrant a repricing for what brokers can charge their clients.”

5. John Gilbert, Co-founder/Director Prime-EX

“The acceptance of cryptocurrencies into mainstream investment portfolios equals more buyers this year for major ticket items, such as houses. Many purchases are coming from people who have never purchased real estate before. This equals more sales for real estate agents who are willing to learn about cryptocurrencies, more sales for real estate agents who are willing to market to people who are invested in cryptocurrencies, and more sales for real estate agents who are willing to specialize in educating their home sellers on how to accept cryptocurrencies as payment in kind for their real estate.

“The cryptocurrency genie will not be put back into the bottle.”

6. Avani Desai, CEO & Co-founder of MyCryptoAlert

“Crypto will allow a homebuyer to gather funds quickly, sometimes in less than 60 seconds, and into the hands of the seller, instantaneously. All of this is done on the blockchain, so the transaction is recorded in an open distributed ledger using encryption techniques that ensure that a transaction was complete and accurate and can never be retroactively changed. I believe what brokers and agents are going to see aside from transactions being done with crypto are technology platforms that are built on the blockchain. Therefore, understanding the two most known and built on blockchains that are out there—the bitcoin blockchain and the Ethereum blockchain—is crucial. Agents will see everything from smart contracts executed, to title storage, to international money exchanges.”

7. Alan Lewis, Chief Investment Officer at DiversyFund

“We are already seeing real estate sellers finding creative ways to accept crypto from a buyer in order to expand the pool of potential purchasers. As a real estate investment platform, our online customers have prompted us to look into accepting crypto and also launch an Initial Coin Offering (ICO) that is backed by real estate assets, which creates a perfect marriage of old and new asset classes.”

8. Sheryl Lowe, Broker Associate, Kuper Sotheby’s International Realty

“In all of my 33 years of closing transactions, I honestly couldn’t have expected something so unique to go so smoothly. In a matter of 10 minutes, the bitcoin was changed to U.S. dollars and the deal was done!

“Of course, it helped to have the right team behind this—Laura Pagnozzi of Independence Title was a key player in keeping everything together.”

9. Hyun Lee, Communications & Marketing Director, Mothership Foundation

“With Ethereum, there are companies that wish to build smart contracts around existing services, including real estate. This allows for a fully digital real estate transaction. In fact, the first real estate transaction using only the Ethereum blockchain already happened. Michael Arrington, co-founder of TechCrunch, recently purchased a Kiev studio apartment for $60,000 via smart contracts on the Ethereum blockchain.

“In this case, the smart contract allowed the sale of the property. If this template was to be copied and applied to all future sales, I would imagine real estate agents would need to pick up on using smart contracts.”

10. Dr. Lucas Lu, Founder/CEO, 5miles

“Fractional ownership. The high cost of home ownership in more and more markets has priced out many potential homebuyers, leaving them on the sidelines.

“Just as USD can be bought and sold in fractions, in a similar way the number of whole bitcoins (BTCs), for example, has a limit and can be used fractionally. This means that cryptocurrency holders can see the value of their currency rise, but also can pool their crypto resources with owners to purchase properties collectively, as investments.”

Bottom Line

No matter how much you fight it, bitcoin and the blockchain technology it runs on will revolutionize the real estate industry. Since your buyers and sellers will be curious about the potential of bitcoin for their transactions, agents need to have a basic understanding of how this technology works. This will not only allow them to represent their clients better, but also help attract and retain tech-savvy buyers and sellers, and create a buzz with marketing.