What are the New Changes to Real Estate in California?

The real estate landscape has recently undergone significant changes, especially regarding the way agent compensation is handled and how listings are presented in the MLS (Multiple Listing Service). These adjustments, which took effect on August 6th, 2024, aim to bring more transparency to the real estate process but have also introduced some complexities that both sellers and buyers need to be aware of. Here's a breakdown of what these changes mean for you:

FOR SELLERS

- Agent Compensation:

- Traditionally, the seller's listing included an offer to compensate the buyer's agent, which was clearly stated in the MLS. With the new rules, this compensation cannot be listed in the MLS, at least for now. However, this does not mean you, as a seller, are no longer participating in the buyer’s agent compensation. You can still choose to offer compensation, but it won’t be explicitly mentioned in the MLS.

- In many other areas of California, the MLS now has a box indicating whether the seller is participating in the buyer's agent compensation. This allows buyers to decide whether to view properties based on the seller's participation in agent fees. Our local MLS is being urged to adopt this practice, but changes are still pending.

- Advertising Restrictions:

- Another change is the restriction on advertising your willingness to compensate the buyer's agent on websites linked to the MLS. However, you can still mention this in social media posts that are not directly connected to any MLS listing.

- Increased Paperwork:

- With these changes, sellers will need to sign additional forms when listing their properties. The goal is to ensure transparency, but the process has become more complex and may cause some confusion.

FOR BUYERS

- New Mandatory Form – BRBC:

- As a buyer, you will now need to sign a new form called the Buyer Representation and Broker Compensation (BRBC) before you can be shown any property. This replaces the older BRE form that outlined the duties between you and your agent.

- The BRBC form includes a section where you agree on the amount of compensation you are willing to pay your buyer’s agent. In most cases, this may be a non-issue as sellers are still likely to offer compensation.

- Buyer’s Agent Compensation Reference:

- When submitting an offer, your buyer’s agent will now include a form that references the fees they expect the seller to contribute towards their compensation. This is a new requirement that has been introduced with the changes.

- Consultations and Clarity:

- Given the complexities of these changes, it’s more important than ever to have a thorough consultation with your buyer’s agent. Ensure that you understand all the forms, fees, and the overall process to avoid any confusion.

WORK IN PROGRESS

As these changes are just being implemented, expect some growing pains as the industry adjusts. It’s a significant shift from how real estate transactions have traditionally been conducted, and many people, including agents, are still getting up to speed.

Our team is committed to staying informed and up-to-date with the latest developments. We’re here to help you navigate these changes smoothly and answer any questions you may have. We appreciate your patience as we all adapt to this new way of conducting real estate transactions.

If you have any concerns or need further clarification, don’t hesitate to reach out. We’re here to ensure you’re well-informed and comfortable with every step of your real estate journey.

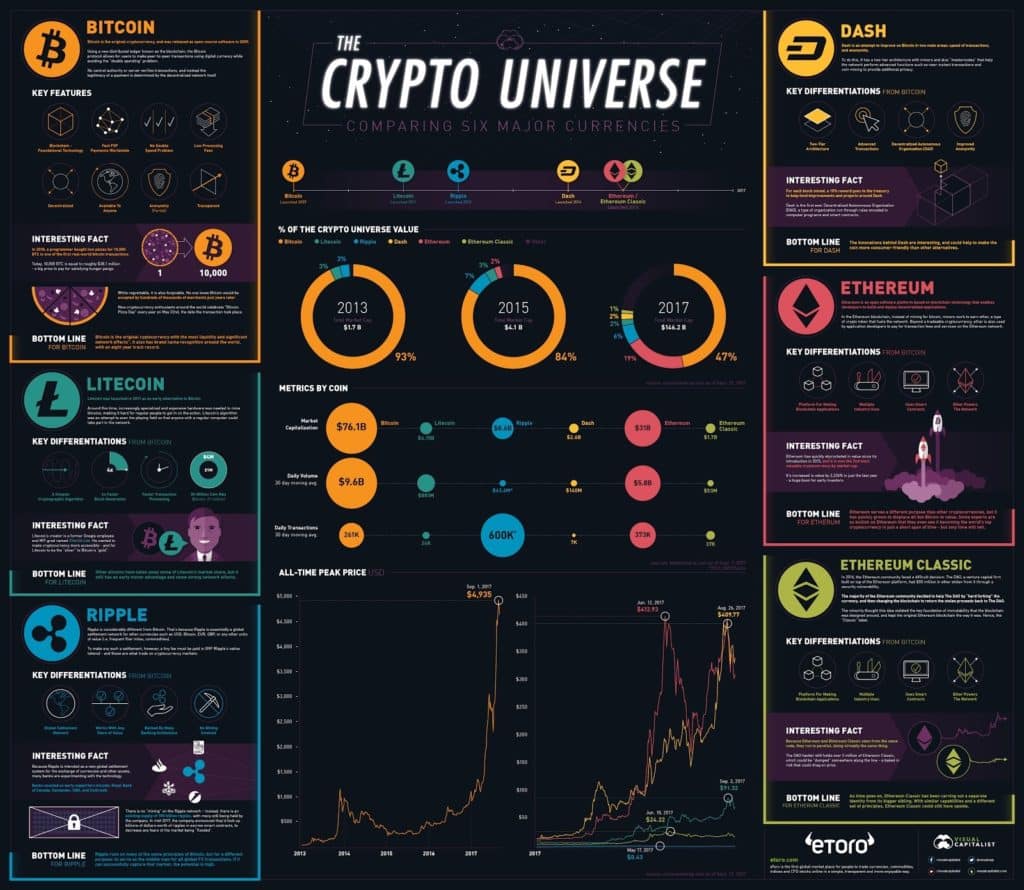

“I’ll sell my house for bitcoin” is the latest marketing tactic, and it’s working … at least for publicity.”

“I’ll sell my house for bitcoin” is the latest marketing tactic, and it’s working … at least for publicity.”

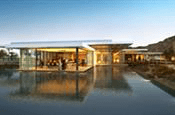

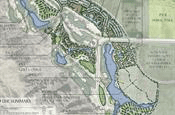

An architect's rendering of a new development planned for the corner of Highway 111 and Miles Avenue in Indian Wells. The project would build roughly 300 hotel rooms, along with condos and villas. (Photo: Submitted photo: TMC Group)

An architect's rendering of a new development planned for the corner of Highway 111 and Miles Avenue in Indian Wells. The project would build roughly 300 hotel rooms, along with condos and villas. (Photo: Submitted photo: TMC Group)